Rising cost of living is actually growing while in the 2021-2022, this is why throughout the surge in time prices after the conflict inside the Ukraine, it is an informed guess that rates might have to go up to battle that it. So you’re able to see the matter of one’s French bodies that particular French consumers do have trouble with ascending mortgage payments. Nevertheless they may have targetted help for the the individuals, in lieu of clobbering anyone. Together with, if they examined the dwelling of French Mortgage Market (pick less than), they’d provides realized one merely a small % away from French borrowers was basically into variable rates mortgages.

Towards the end out-of 2023, We heard profile regarding regional Real estate professionals and Mortgage brokers, one certain finance companies for the France had just avoided handing out the fresh new mortgages, while they had attained the upper restriction loan places Okahumpka of credit matter the Banque de France got specified. A lot of family buyers have been are advised to re-complete applications in early 2024.

You can find the effect these regulatory changes got towards Financial field within the France out of this graph produced by the fresh Banque de- France. In the , following the sustained stress of away from loan providers, finance companies, mortgage brokers and you may Real estate professionals, the government started to right back-track. New French Loans Minister together with Banque de- France conceded one to in the event no less than 10% of the property loan will go to the restoration works, the borrowed funds money are spread-over twenty seven decades in the place of 25 years. However, the present day restriction restrict off twenty five years to have a standard mortgage will remain. Throughout 2024, I expect that more ‘reforms’ would-be established, especially considering that the tips unfairly penalise basic-date customers.

French mortgage markets build

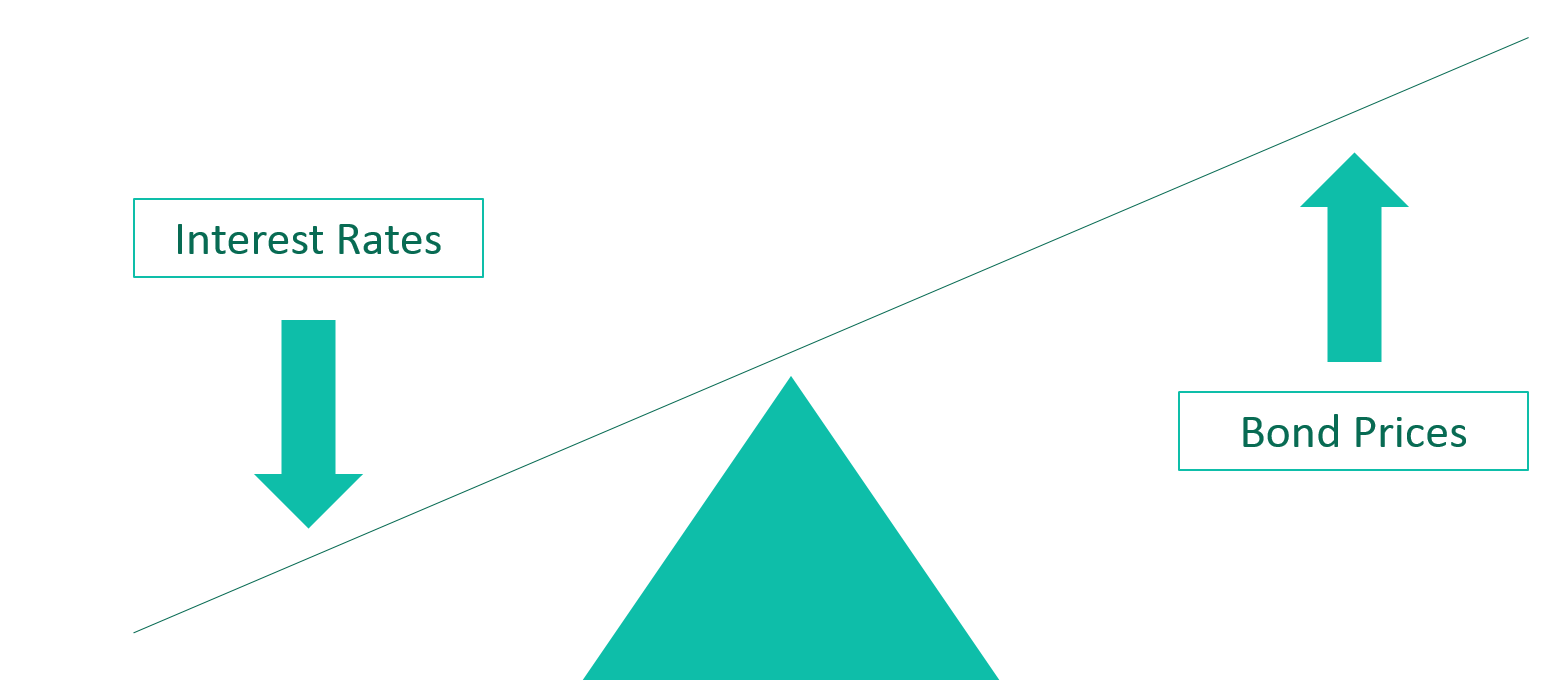

The dwelling of one’s home loan market into the France, features helped secure a good amount of French borrowers regarding impact out-of rising interest rates. Around 85% away from casing loans inside the France are fees mortgage loans. The latest relative stability regarding repaired rate mortgages inside France, have enjoy the country’s mortgage , the newest current Coronavirus Pandemic therefore the Opportunity crisis off 2022.

In addition, having family costs ascending for five successive many years between 2017 so you’re able to 2022, it offers allowed French property owners to build highest accounts out-of capital in their house (as the the loan wide variety is faster and you will possessions valuations raise). Over the past several years, the fresh French mortgage field has grown immensely. With regards to the Federal Institute to possess Mathematical and you can Monetary Degree (INSEE), France have one of many world’s largest home loan locations and French mortgage loans have raised inside value of 21% regarding France’s GDP in 2000, to help you forty two% of GDP in 2022.

Household cost inside France 2023-2024

Throughout the 2022 family prices in the France proceeded to increase by +six.7% (on the mediocre price for homes recording an increase out-of +8.2% and you may accommodations during the +cuatro.5%). Throughout the 2022, what amount of household conversion process in the France remained more than step 1.1 million, that have sales getting together with step 1,133,000 from the 1 year as much as Q3 2022 – which is the 6th higher every quarter rate over the past 17 ages [SOURCE: Bilan Immobilier 2022 ].

The Notaires de France features noted your housing market within the France during the last 5 years enjoys saw nearly unprecedented accounts of increases both in regards to rates (home prices have increased from the +twenty-seven.8% during the last 5 years from inside the mainland France) together with number of property transformation – brand new moving average from possessions sales enjoys strike more one million inside the 13 from the history 20 home. (Source: ).

Which headline figure does cover-up particular regional variations in home cost inside the France, however, history shows that the newest enough time-name trend from property pricing during the France is certainly right up. What’s out-of style of appeal is the fact that UK’s Brexit choice does not seem to have a serious effect on the amounts away from United kingdom customers proving a desire for new French property sector.