Here’s how every one of these aspects make a difference to their borrowing sense-and how to ensure you get the best conditions getting your loan.

Rates

Rates is the biggest signal out of mortgage affordability, so evaluating the options is important. That equipment on the collection is actually checking your own Apr ahead of officially applying for that loan.

Many loan providers render individualized rates that have a softer borrowing from the bank query, which allows one to compare cost in place of destroying the rating by way of a challenging credit eliminate.

This isn’t the situation for all loan providers, therefore find out which kind of borrowing from the bank inquiry the lending company work in advance of entry your data. Also, ready yourself to publish files, such as for example pay stubs, to verify your data. Their price or approval you may changes if the financial can not be certain that some thing.

Conditions

It is https://paydayloanalabama.com/nixburg/ well-known to see words private money continue of one or two so you can half a dozen years. If you get multiple selection with assorted installment conditions, bear in mind the entire price of financing will vary according to the period of their installment agenda.

A longer identity setting less monthly payment, however you will spend even more attract. The opposite holds true for a shorter name.

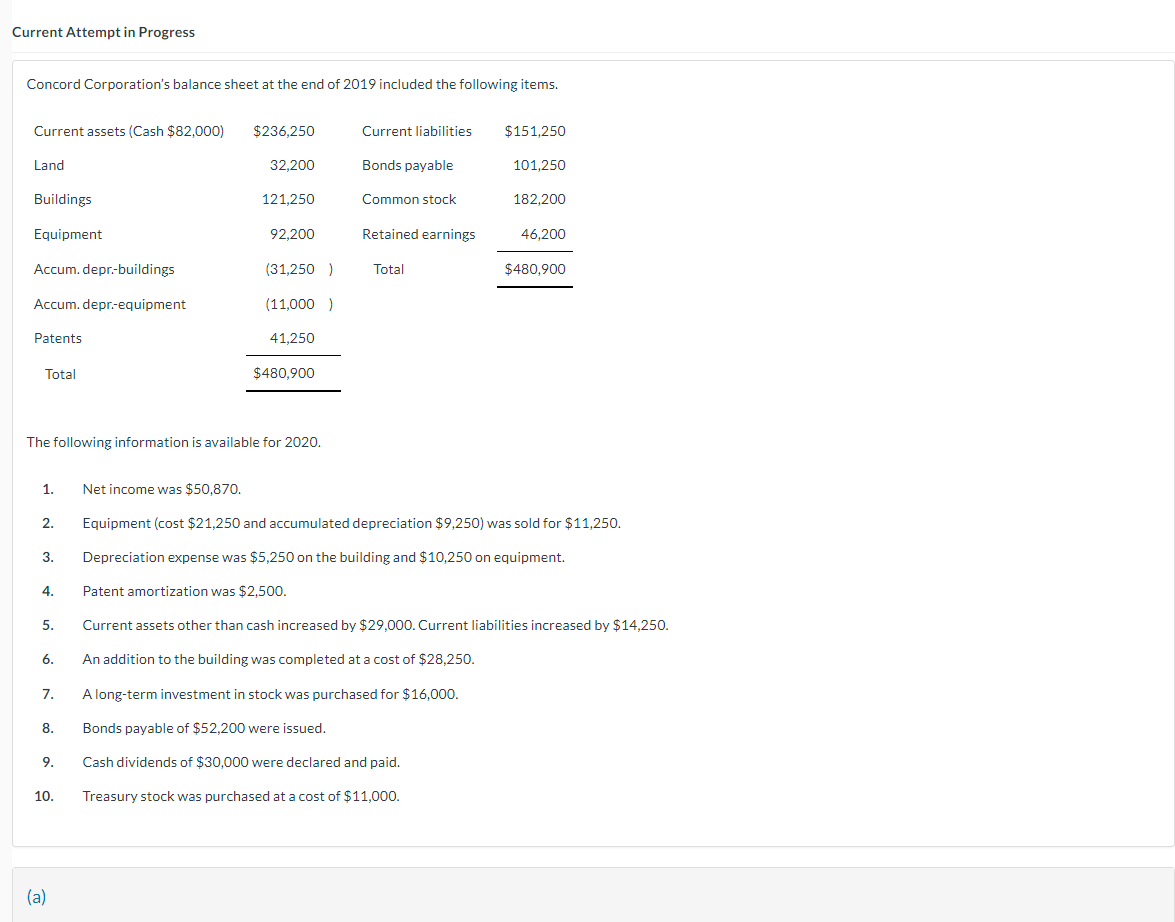

The brand new dining table less than shows exactly how mortgage terms change the monthly installments and you will overall interest bills having an effective $ten,000 loan having an effective % APR:

Part of the payment to possess home improvement funds was a one-go out origination percentage. Origination costs can use to each debtor, not merely those with poor credit (however your percentage could be higher considering your credit score). The official in which you live and affects your origination commission.

An origination commission can make your loan less costly, but not. A lender offering a lowered interest you are going to charge increased origination fee to cover company will cost you. Particular loan providers do the commission outside of the principal balance during the origination, while some include it with your instalments.

Consumer product reviews

Plus, check if or not we keeps examined the company. We lookup of numerous areas of signature loans, as well as exactly what customers state, and then we simply take pleasure within the giving unbiased consumer loan analysis thus it is possible to make an informed choice to suit your funds.

Do it yourself application for the loan techniques

Quite a few of the present loan providers promote on the internet programs you could done within the a few minutes. Even better, of a lot is going to do a mellow inquiry, providing you best towards matter you’ll be eligible for along with your speed as opposed to move the borrowing from the bank. Here is how it really works:

- Gather their proof income and you can name. Which have records just like your We.D. and you will shell out stubs able before you apply can save you date that assist you earn a choice shorter.

- Prequalify towards the lender’s webpages. Checking their prices on the internet always merely requires a couple of minutes. You can input pointers such as your title and you can target, and past four digits of your own Personal Security count. It is possible to need certainly to county exactly how much we want to borrow and exactly how you will use your loan.

- Discover financing alternative. Your own financial will get make available to you one or more financing render. Imagine for every single a person’s pricing and you may terms, and rehearse the commission calculator to compare borrowing can cost you. Before you go, purchase the alternative you to definitely best fits your position.

- Invest in a hard credit assessment. Prequalifying merely pertains to a flaccid eliminate, but when you want to fill in the full app, you will have to say yes to a painful credit score assessment before you could is go-ahead.

- Give earnings and you may label confirmation. Contained in this step, possible promote a great deal more thorough advice, such as your full Personal Shelter matter. Additionally, you will upload brand new records you gathered in past times. This action is often the longest action, based on how of many documents you need to publish just in case you have them stored digitally.