Mortgage loans and you will mortgage brokers, some body will confuse the 2. Thus, in advance of i plunge for the electronic bank report studies for mortgage financing, let us lost some light about what it is.

A mortgage was a loan you’re taking so you can both pick property or even build it. The property should be residential. The financial institution otherwise bank improves you the funds required to buy property, that you after pay-off in the different EMI plans.

Mortgage loans are loans facing a house you currently own. The house are going to be residential otherwise commercial. You could utilise the mortgage amount to have one thing, regarding capital your own newborns advanced schooling so you’re able to broadening your company. There aren’t any constraints about precisely how spent the cash.

More over, anyone can bring a mortgage loan salaried anyone, self-employed anyone, etc. However, additional mortgage brokers are apt to have some other financing criteria.

What is actually home loan underwriting?

Home loan underwriting is where a loan provider assesses if a debtor match the mortgage criteria and you may whether or not they normally pay the mortgage or maybe not. Besides comparing this new borrower’s creditworthiness, it decides simply how much mortgage he or she is eligible for.

During the underwriting, the lending company monitors lots of items on your financial report. For-instance, they’ll search when you have a stable income. They are going to also judge if you have sufficient savings to keep investing the borrowed funds payments for people who treat your task or deal with an effective monetary disaster.

A different foundation they keep in mind is actually an unexplained influx off highest bucks numbers. These are generally going to question you on source of the new deposit. Overdrafts is actually yet another critical section of financial report studies and you will have a tendency to a reason for real estate loan getting rejected.

As to why have fun with a digital lender report study?

Both for mortgage brokers and you may borrowers, the conventional underwriting procedure that boasts instructions verification and you can lender statement data is difficult. It is pitted with troubles and risks.

As an instance, yourself seeking out just the right statements demands many straight back and you will forward. It generates rubbing and you will drags the fresh origination procedure. Furthermore, parsing because of all those related documents are mind-numbing. Very, they besides takes prolonged but also fails to create well worth to help you sometimes party.

By digitising the new membership statements analysis, both lending company and you can borrower sidestep all the circumstances. You don’t payday loans no credit check Knollcrest CT need to to help you find out data and you will scrutinise them line by line towards the borrower’s credit score assessment. The entire processes regarding report upload to credit score goes instantly.

How come electronic bank report study work?

A bank declaration analyser instance Precisa is a straightforward-to-explore web software. Permits loan providers to view the lending company comments out-of a debtor in person and in an organised means. But over you to, it’s got actionable skills due to an user-friendly dashboard, having fun with actual-time research.

The latest safer, safe and you can simpler product components financial study away from bank statements. They kinds most of the lender transactions to your some other categories and you will analyses these to room anomalies and you can fake circumstances. Eventually, they assigns a rating you to validates the fresh new credibility of your own borrower.

1. Checking inwards and you may outward financing move

Prior to a lender normally approve a loan, one of many aspects it appraise was outflow and you can inflow out-of financing of your own debtor. Contrasting an equivalent support lenders mark needed wisdom.

Having a hack, it is as easy as clicking on the Statement tab. You immediately score reveal research of your own bank account, within which one classification is actually finance outflow/inflow.

From EMIs in order to bank charges, of utilities to help you cash detachment, every outflow out of finance is actually showed here. Likewise, the brand new loss suggests this new inflow from finance, including income, income, this new money, etc.

Then, the latest application assigns a beneficial volatility get for the borrower. In case your score is 0, it indicates the new membership try secure that have consistent inflow and you can outflow. In the event your score try step 1, it implies action with contradictory inflow and you can outflow. Utilising the volatility get, lenders normally finest courtroom the brand new debtor.

dos. Identifying circular transactions

An introduction to brand new inwards and external circulate away from funds try a simple action in order to figuring economic wellness. However, more very important try detecting the back-and-forward of the same money anywhere between separate bank account of borrower. Precisa now offers a rounded purchases loss to measure merely particularly financing move.

2. Discovering skeptical hobby

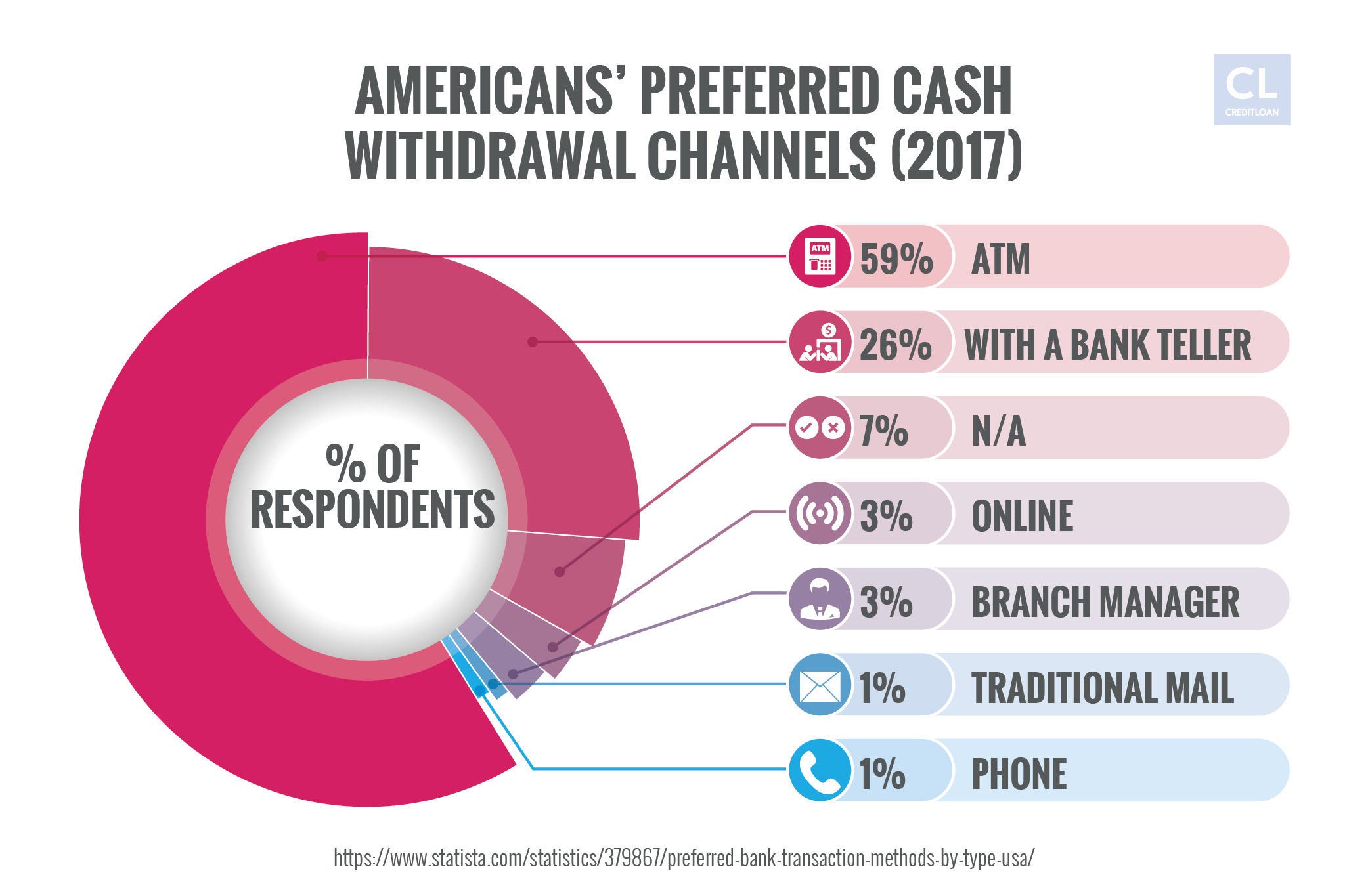

A critical step you to definitely a lending company requires in advance of sanctioning an effective financing is seeking away people skeptical activities regarding checking account. Such as, are there Automatic teller machine withdrawals up to INR 20,000? Contains the debtor transferred cheques to the bank holidays? Is there a good mismatch regarding report and you will calculated balance?

Such facts can indicate the poor trustworthiness of your debtor. Precisa automatically detects such as for example questionable deals and you will flags all of them for your requirements. Thus, you don’t have to diving strong towards the financial declaration data so you’re able to discover them your self.

3. Finding bounced cheques

Mortgage lenders and additionally cause for bounced cheques in underwriting procedure. Having digital studies, they don’t have in order to scrutinise numerous deals. A great bounced cheque tab would immediately let you know new ins and outs of all of the inward and you may outward cheques with tags, cheque amount, go out, matter and you can harmony. Ergo, making it possible for the financial institution to arrive an informed choice.

Change to Digital Financial Declaration Data Now!

All the mortgage lender knows that guide techniques throw up significantly more dilemmas than it solve. Thus, you’ll find less come back users. Ideas are lower and you will complete support are abysmal.

Electronic confirmation removes all of these inquiries. They modernises the process and eradicates friction. It increase it through the elimination of committed lenders spend on the brand new underwriting processes. Total, borrowers move through this new transformation utilize faster, permitting income.

More speeding up the process, an automatic procedure takes away the risk of one ripoff. Instructions verification will lets fake cheques or doubtful dumps in order to travel underneath the radar because bodily documents is unreliable and have now good-sized room for mistakes. And you will where discover a danger of ripoff, there can be a high chance of defaulters.

With an online bank declaration studies equipment eg Precisa, you get access to perfect, real-date advice. Loan providers, banks, and other creditors is use it and work out research-recognized conclusion.

The fresh new device has actually every safety evaluate you need built into they. They brings an entire picture of this new borrower regarding learning bank statements within a few minutes to look for transactional habits so you can financing cost opportunities rating.

Therefore, make procedure of confirming brand new creditworthiness of borrowers having our very own lender report studies engine issues-free and cost-energetic. Try out Precisa’s fourteen-big date Free trial!