These requirements assist lenders evaluate your capability to repay the mortgage responsibly

display that it:

Unlocking the potential of your own home’s guarantee using a property Equity Line of credit (HELOC) also provide home owners with financial independence. A good HELOC differs from a timeless domestic guarantee loan by offering a good revolving credit line, enabling you to borrow funds as needed to their approved restriction. Knowing the HELOC application process, in addition to qualification requirements together with draw and you can fees attacks, is essential in making advised monetary decisions.

Qualifying to possess a good HELOC: Key Standards

To gain acceptance for a good HELOC, loan providers generally imagine multiple circumstances, also how much cash guarantee you may have of your home, your credit rating, and your loans-to-earnings ratio.

Sufficient Family Security

To help you be eligible for good HELOC, people need to have sufficient collateral inside their assets. Equity is the difference in your house’s economy value and you may your own a fantastic home loan equilibrium. Such as for instance, should your residence is respected during the $3 hundred,000 along with home financing balance out-of $150,000, your house collateral try $150,000. Loan providers usually want consumers to own no less than 1520% security ahead of granting a good HELOC app. It means your own mortgage equilibrium should be 8085% otherwise less of their home’s worthy of.

Legitimate Money

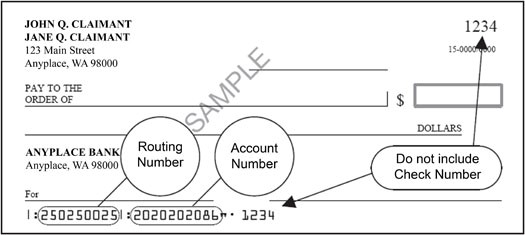

Loan providers wanted proof uniform money to ensure you might do the other monthly premiums with the good HELOC. In order to qualify, you might have to promote records eg:

- A job income. W-2 function, lender comments, and you may previous shell out stubs

- Self-employment income. Tax returns and you will finances losings comments

- Retirement earnings. Public Coverage comments, retirement, or annuity advice

- Other earnings offer. Read more