How exactly to Clipped Several thousand dollars And you may Years Off Your own Financial With Good HELOC

This few days we generated a good $twenty-five,000 principal commission into our mortgage and therefore got our very own projected focus with this household away from $127,503 so you’re able to $112,776. Thus not only performed so it huge dominating fee help save all of us almost $fifteen,000, in addition slice the life of our very own mortgage down because of the almost annually. And therefore we’re one year closer tobeing home loan 100 % free!

Now before you believe I am bragging about that have $25,000 to place upon the mortgage, you need to know this money originated in a house Security Line of credit, or a HELOC. Pay attention closely if you would like stop the interest payments inside the the balls!

Having fun with good HELOC to cut down their homeloan payment was of many things: wise, economical, practical, but it addittionally takes discipline, management, and you can thought. Do you do that? Naturally you could! You are the steward of your own earnings! Very let’s accomplish that!

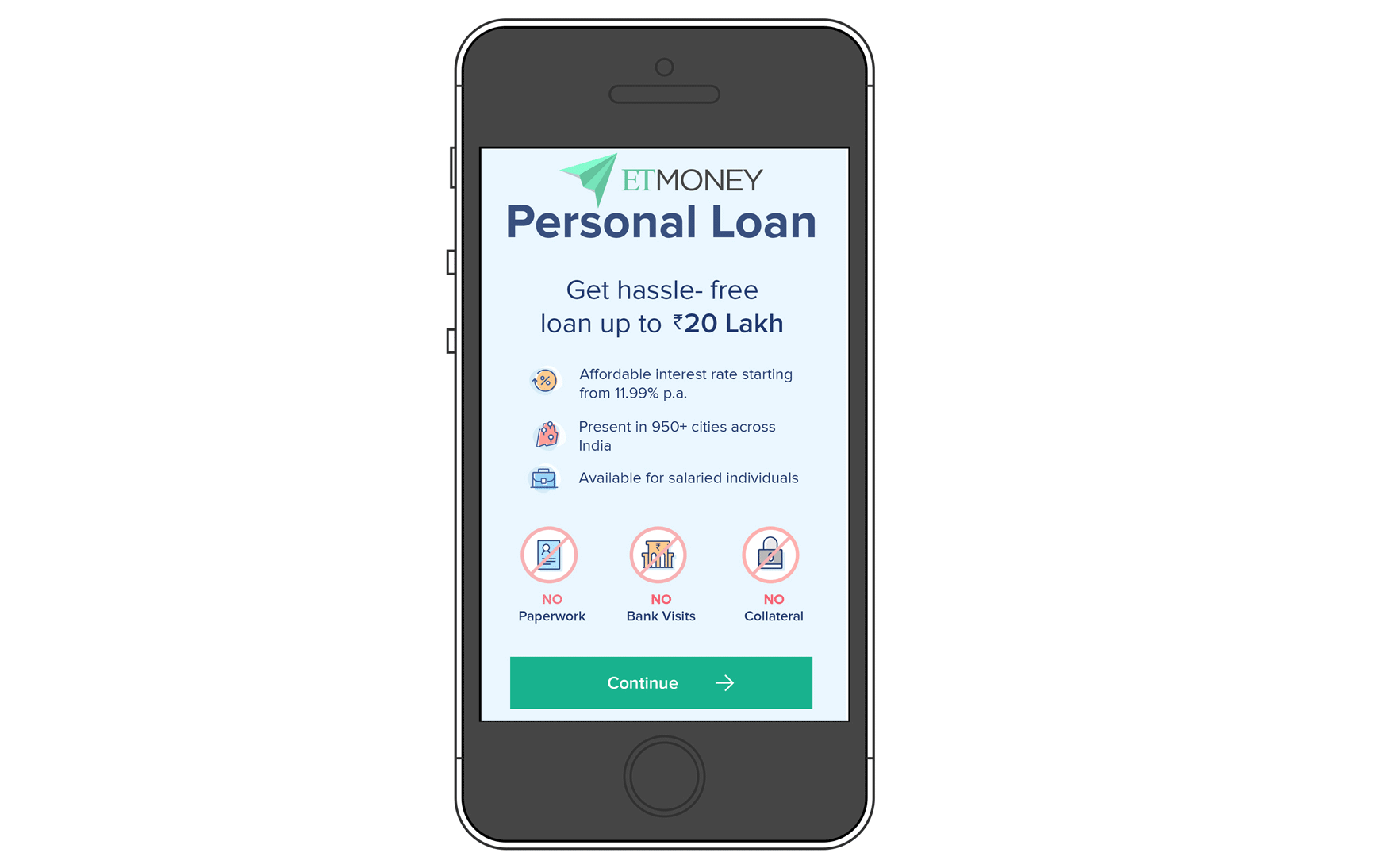

Your submit an application for they during the a financial

A good HELOC try a loan based on the guarantee in your household. Most banking institutions do that. State you reside worth $100,000 as well as your left financial balance try $50,000. This means that you have $50,000 value of equity for the reason that household. You can get a loan on that guarantee while the lender throws a note on your own house stating that when the some thing bad goes , it get money straight back and the fresh mortgage-holder. Read more