How would you like a degree to-be a loan manager for the California?

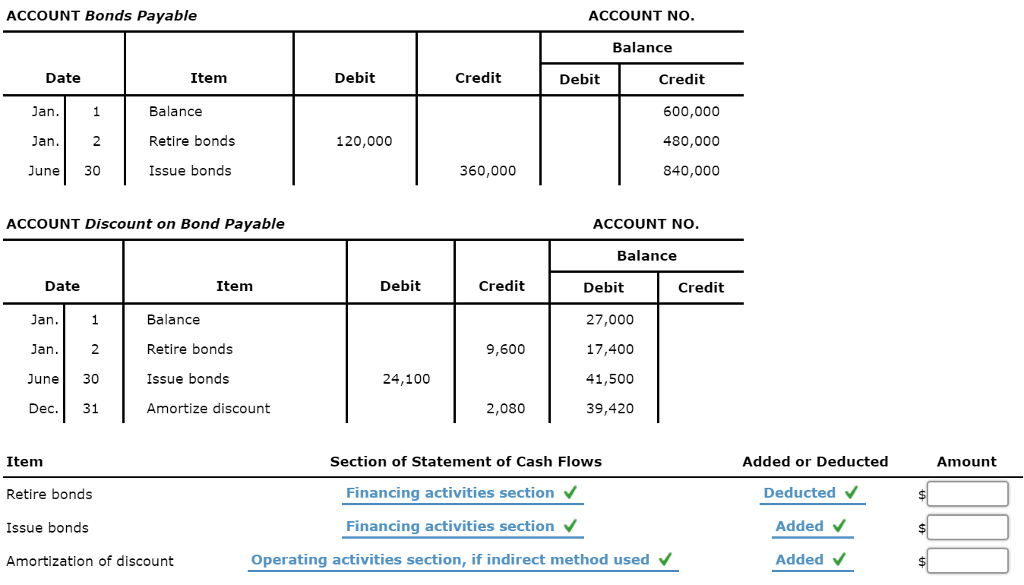

This action includes entry to have specialized Ca licensure through the NMLS licensing portal. Brand new NMLS app percentage try $30, together with you are going to need to shell out $300 into Ca portion of the licensing commission. And you can, to possess a good $15 fee, a credit report should be registered during the latest software. To learn more about rates, you can check out the brand new California MLO licenses application record. The application form when you look at the Ca can cost you $105 complete. Complete with the price of the fresh NMLS operating.

six. Get manager support

Until your employer sponsorship are affirmed into the NMLS, their California mortgage loan administrator permit will remain in pending reputation. The desired confirmation is carried out in the NMLS webpage. You will then must go to the function submitting domestic screen and click company availableness.

At this point, you may be caused to incorporate your employer support by the submitting work information. Just after the supporting company obtains find of the verification demand, capable agree your support. Pending recognition, you are officially signed up.

For standard recommendations into becoming that loan manager (not only in California), discover the report about how to be a mortgage loan administrator inside the 10 tips.

To really get your financing officer permit for the Ca, you will have to shell out a number of some other charges. When implementing from NMLS certification site, might shell out a loan application payment out of $31. You will also be required to pay $three hundred for the California portion of the licensing commission. Read more