display that it:

Unlocking the potential of your own home’s guarantee using a property Equity Line of credit (HELOC) also provide home owners with financial independence. A good HELOC differs from a timeless domestic guarantee loan by offering a good revolving credit line, enabling you to borrow funds as needed to their approved restriction. Knowing the HELOC application process, in addition to qualification requirements together with draw and you can fees attacks, is essential in making advised monetary decisions.

Qualifying to possess a good HELOC: Key Standards

To gain acceptance for a good HELOC, loan providers generally imagine multiple circumstances, also how much cash guarantee you may have of your home, your credit rating, and your loans-to-earnings ratio.

Sufficient Family Security

To help you be eligible for good HELOC, people need to have sufficient collateral inside their assets. Equity is the difference in your house’s economy value and you may your own a fantastic home loan equilibrium. Such as for instance, should your residence is respected during the $3 hundred,000 along with home financing balance out-of $150,000, your house collateral try $150,000. Loan providers usually want consumers to own no less than 1520% security ahead of granting a good HELOC app. It means your own mortgage equilibrium should be 8085% otherwise less of their home’s worthy of.

Legitimate Money

Loan providers wanted proof uniform money to ensure you might do the other monthly premiums with the good HELOC. In order to qualify, you might have to promote records eg:

- A job income. W-2 function, lender comments, and you may previous shell out stubs

- Self-employment income. Tax returns and you will finances losings comments

- Retirement earnings. Public Coverage comments, retirement, or annuity advice

- Other earnings offer. Files your most money, including leasing assets money otherwise financing yields

Good Creditworthiness

A strong credit rating and you may in charge credit government are essential to have HELOC acceptance. Loan providers very carefully evaluate your creditworthiness to decide the loan eligibility. A credit history normally above 680, along with a routine reputation of to the-go out payments, shows debt precision. Building and keeping a strong borrowing from the bank reputation helps you safe favorable HELOC terms and conditions.

Reasonable Personal debt-to-Money Ratio

The debt-to-money (DTI) proportion procedures their monthly debt costs (playing cards, automotive loans, etcetera.) in line with your revenue. Lenders fool around with DTI to evaluate what you can do to deal with most financial loans. A lesser DTI, generally speaking less than 43% payday loan Semmes, generally improves your chances of HELOC acceptance. To change their DTI, envision settling existing personal debt, growing earnings, otherwise refinancing highest-desire funds.

Wisdom HELOC Mark and Cost Episodes

A beneficial HELOC works in 2 phase: the brand new draw period as well as the installment period. When you look at the draw months, typically long-lasting from around 5 in order to a decade, you can access finance as required, to your own borrowing limit. You are basically obligated to build attention-simply money during this period, however financial institutions may require money towards the principal. Because draw months concludes, this new fees several months initiate, and you’ll generate both principal and you may appeal payments. The length of it phase may vary by bank, but may manage anywhere from 5 so you’re able to twenty years.

Tips Make an application for a HELOC

Securing a house Guarantee Credit line relates to numerous steps. Of the knowledge these types of steps, you can navigate the fresh HELOC app procedure and come up with informed behavior.

step 1 | Assemble necessary files

To help you begin brand new HELOC application, gather very important data files such proof of income (spend stubs, taxation statements), homeownership verification (assets goverment tax bill, financial report), and you can identity. Which have these records available commonly improve the application form processes.

dos | Complete the application

Very creditors give on the internet apps to possess benefits, even though some banks and credit unions choose your use from inside the-people at the a region branch. Be ready to promote detailed information regarding the financial situation, assets, and you may desired HELOC terms.

3 | Wait from the underwriting procedure

Lenders have a tendency to comment the application, evaluate the creditworthiness, and you can make sure your income and you may property value. This course of action start around property appraisal to decide their residence’s market well worth.

4 | Close into HELOC

Upon approval, you’re getting financing arrangement explaining this new small print. You’ll want to signal the mortgage arrangement and you can pay one closure can cost you, in the event that applicable. A short wishing months, always a few days, enables you to opinion the fresh terms until the mortgage becomes productive.

5 | Availableness Their HELOC

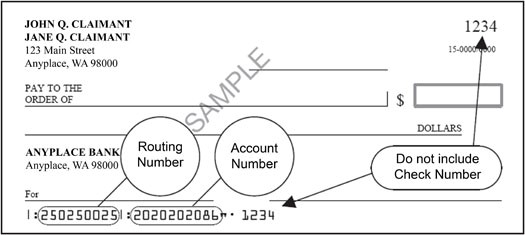

After the closure techniques, you can get access to their HELOC financing. That it always pertains to searching a checkbook getting withdrawals, while some lenders will let you transfer the funds into your personal checking account.

Ready to open the potential of their residence’s security? Lifestyle Family Borrowing from the bank Connection now offers competitive HELOC choice tailored on needs. Our knowledgeable lenders is actually here to guide you through the processes that assist you make informed conclusion. E mail us today to get the full story and commence the HELOC excursion.