Considering the purse-pushing ramifications of the brand new previous leasing market, of several Floridians are thinking about to order a property unlike leasing. The procedure feels daunting, especially if you lack money saved to have an advance payment otherwise are worried concerning your credit rating.

According to the Federal Association regarding Realtors, first-time homeowners merely take into account 1-in-step three property marketed all over the country even after several low-and-no-down-fee mortgage loans.

Possibly potential customers feel capital a house may be out of its started to and you can unacquainted with programs that can help. Maybe you might be one of them, of course so, this really is probably good news to you.

Assist getting First-Date Homeowners

First, you will need to keep in mind that first-big date homebuyers is a little of good misnomer. Whoever has not yet owned a property into the three years is known as a primary-time home buyer. It indicates you might be a qualified basic-date household client in the event you have possessed property in advance of.

Florida also provides programs offered from County Property Initiative Commitment System (SHIP). Money from this program is actually distributed to Florida’s 62 counties due to the fact cut off provides. For every county gets money, and every state is needed to have fun with that cash payday loans 1000 dollars predicated on Vessel requisite.

Contacting their county’s Area Development Place of work is a superb first step to help you distinguishing the program being qualified truth to suit your state.

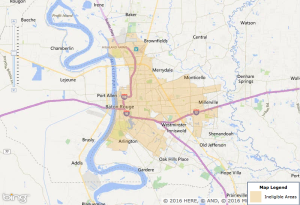

Using Pasco County in west central Fl including, the funds quantity of the latest applicant’s household find qualifications to have applications along with entry to Florida Property Power (FHA) mortgage choices and you may advance payment recommendations grants or loans.

Down payment advice scholarships can be used together which have a keen FHA financial, bringing even more assist to potential home purchasers.

During the Pasco State, curious users must take a keen 7-hour group given through the Tampa Bay People Creativity Enterprise and you can work with a medication bank and you will real estate agent so you’re able to meet the requirements to own Boat apps. Extremely counties possess similar conditions.

Money eligibility constraints getting Ship apps are ready by the County away from Florida. Areas can use one or more of appointed Adjusted Average Income (AMI) profile to decide program eligibility.

AMI ‘s the midpoint regarding a good region’s money distribution. Half of new family in this part make over one to matter and half of could make quicker. The latest U.S. Construction and you can Urban Invention (HUD) place of work works out which number for each and every metropolitan and outlying are in the world.

So, such, in the event the midpoint income to own a location is $fifty,one hundred thousand, so you can qualify for a downpayment assistance program, your income have to be ranging from $forty,100000 and you may $60,one hundred thousand.

An initial-big date household client whom brings in less than $40,000 or smaller can be receive a 30-12 months fixed-speed home loan that have a zero-% rate of interest without down payment. People making anywhere between $forty,100000 and $sixty,100 is at the mercy of downpayment conditions, however, luckily, you’ll find software that can help with that too.

First-date people can put on to have good step 3% otherwise cuatro% Housing Money Institution (HFA) popular deposit offer. The new give count is based on the purchase price of one’s house, and you can in the place of loans, provides need not getting paid down.

If you’re not qualified to receive HFA deposit offer, discover selection. New Fl Let Loan offers so you’re able to $eight,five-hundred for usage having down payment and/or settlement costs, and the Fl Homeownership 2nd Financial provides to $10,100000.

The latest Part of Credit ratings

While you are money ‘s the first idea regarding eligibility, deficiencies in credit history or less than perfect credit should be a burden to help you homeownership. A credit history of at least 560 is needed getting qualifications for the majority of software, but a rating one to lowest will mean a higher interest rate and possibly an increased down-payment burden.

A credit score of at least 560 will become necessary having Ship mortgage loans, however, additional factors, those not often believed by traditional lenders, help determine whether or perhaps not to help you agree your loan. This type of activities is:

- The price and precise location of the house we need to pick

- Regardless of if a deposit can be made (not needed occasionally, nonetheless it is a good idea)

- What you’re already purchasing lease

- The soundness of your earnings

Help to have Low-First-Time Home buyers

If you’re in the otherwise is actually relocating to a location impacted by the Hurricane Michael, new Hurricane Michael Healing Financing Program provides around $fifteen,100 for deposit guidelines that assist with settlement costs. This zero-per cent notice advance payment recommendations mortgage, doesn’t need monthly payments along with your mortgage and keeps a loan forgiveness bonus once five years of possession.

For many who currently very own property around the official and you will you want significant solutions to help keep your home according to building codes, Boat enjoys software to assist protection those individuals expenditures also.

Any sort of your position, discover help you around to you. Start by their Society Creativity workplace otherwise visit the Florida Watercraft site to find out more.